Turning 65 is a milestone in life. It’s a time for new beginnings, new opportunities, and, for many, new responsibilities when it comes to healthcare. As you approach this age, understanding retirement benefits becomes crucial, particularly in relation to Social Security and financial readiness for retirement. One of the most significant changes is enrolling in Medicare, the U.S. government’s health insurance program for those aged 65 and older. Understanding how Medicare works, when to sign up, and how to navigate the options available can be overwhelming, but you don’t have to go it alone.

If you’re turning 65 or approaching this age, here’s a guide to help you understand what to expect and how the Meagher Agency can assist you in making the best choices for your healthcare needs.

1. Understanding Medicare Eligibility

Medicare eligibility is a crucial aspect of the program, and it’s essential to understand who qualifies. Generally, Medicare is available to individuals who are 65 or older, as well as those with certain disabilities or End-Stage Renal Disease (ESRD). To be eligible, you must be a U.S. citizen or a permanent resident, and you must have worked and paid Medicare taxes for at least 10 years. If you’re under 65, you may still be eligible for Medicare if you receive Social Security Disability Insurance (SSDI) benefits or have been diagnosed with ESRD or ALS (Lou Gehrig’s disease).

1. What is Medicare and Why is it Important?

Medicare is a federal health insurance program designed for people aged 65 and older, as well as some younger individuals with disabilities. It provides essential health care coverage, including hospital visits, medical services, prescription drugs, and even some additional benefits. It’s crucial to understand how Medicare works, as it will likely be your primary source of health coverage once you turn 65.

2. When Should You Enroll in Medicare?

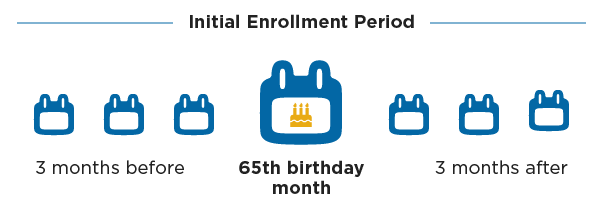

You don’t automatically get enrolled in Medicare just because you turn 65. The Initial Enrollment Period (IEP) is a seven-month window that begins three months before your 65th birthday, includes the month of your birthday, and ends three months after your birthday. It’s critical to sign up during this period to avoid late enrollment penalties.

The timing of your Medicare enrollment can also be influenced by when you choose to start receiving your social security benefits. Planning when to claim these benefits is important, as starting early can result in lower payouts compared to waiting for a higher payout later.

If you’re still working and have health insurance through your employer, you may choose to delay enrollment without penalty, but it’s still a good idea to talk to a professional to understand the implications for your specific situation.

4. Medicare Enrollment Periods

Medicare enrollment periods are critical to understand, as they determine when you can sign up for Medicare coverage. The Initial Enrollment Period (IEP) is the first opportunity to enroll in Medicare, and it begins three months before your 65th birthday and ends three months after. If you miss this period, you can enroll during the General Enrollment Period (GEP), which runs from January 1 to March 31 each year. Additionally, you may be eligible for a Special Enrollment Period (SEP) if you experience a qualifying life event, such as losing your job or moving to a new state.

3. Parts of Medicare: What You Need to Know

Medicare is made up of different parts, and understanding each Medicare part is crucial for making informed decisions about your health coverage. Here’s a breakdown of the key components:

- Part A (Hospital Insurance): Covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health services. Most people don’t pay a monthly premium for Part A if they or their spouse paid Medicare taxes while working.

- Part B (Medical Insurance): Covers outpatient care, doctor visits, preventive services, and other medical services not covered by Part A. Part B does require a monthly premium, which is based on your income.

- Part C (Medicare Advantage): Offered by private insurance companies, Medicare Advantage plans combine the benefits of Part A and Part B, and often include additional benefits like dental, vision, and prescription drug coverage. These plans may offer lower out-of-pocket costs but vary in coverage.

- Part D (Prescription Drug Coverage): Covers prescription medications and helps lower the cost of medications. Part D is also offered through private insurance companies and comes with its own monthly premium.

4. Medicare Supplement (Medigap) vs. Medicare Advantage

When choosing your Medicare coverage, you’ll have to decide between a Medicare Supplement (Medigap) policy or a Medicare Advantage (Part C) plan.

- Medigap plans fill the gaps in traditional Medicare (Parts A and B). These plans help cover out-of-pocket costs like copayments, coinsurance, and deductibles, giving you more predictable costs.

- Medicare Advantage plans are an alternative to traditional Medicare and typically offer extra benefits like dental, vision, and wellness programs. However, these plans often have different networks of doctors and hospitals and may have higher out-of-pocket costs depending on the plan.

5. Prescription Drug Coverage (Part D)

Prescription drug coverage is an essential part of Medicare for many people. If you have existing medications, it’s important to compare Part D plans to find one that fits your needs and budget. The right plan can help you save on the cost of prescriptions, but be aware that not all Part D plans cover every medication. Check the formulary (list of covered drugs) before enrolling in a plan.

8. Health Savings Account (HSA) and Medicare

If you have a Health Savings Account (HSA), it’s essential to understand how it interacts with Medicare. An HSA is a tax-advantaged savings account that allows you to set aside money for medical expenses. However, once you enroll in Medicare, you can no longer contribute to an HSA. If you’re already enrolled in Medicare, you can still use your HSA funds to pay for qualified medical expenses, but you cannot contribute new funds to the account.

9. Medical Insurance Alternatives

While Medicare is a comprehensive health insurance program, it’s not the only option available. Private insurance companies offer alternative medical insurance plans, such as Medicare Advantage plans, which can provide additional benefits and coverage. Medicare Advantage plans are offered by private insurance companies approved by Medicare and must provide all the same benefits as Original Medicare Parts A and B. Additionally, many Medicare Advantage plans include additional benefits, such as coverage for prescription drugs, dental, vision, hearing, and fitness.

6. Medicare Costs You Should Know About

Medicare has premiums, deductibles, and co-pays. Here’s a general breakdown:

- Part A Premium: Most people pay nothing for Part A if they’ve worked and paid Medicare taxes for at least 10 years.

- Part B Premium: The standard Part B premium for 2024 is $174.70 per month, though this amount can vary based on your income.

- Part D Premium: This varies depending on the plan you choose, but the average premium for Part D is about $34 per month in 2024.

- Medicare Advantage Plans: These plans can have premiums, co-pays, and out-of-pocket limits that vary widely. It’s essential to compare plans to find the best value for your healthcare needs.

7. Avoiding Late Enrollment Penalties

It’s important to sign up for Medicare during your Initial Enrollment Period or to have an approved reason for delaying enrollment (such as employer coverage). Failing to enroll on time can result in late enrollment penalties, which can increase your premiums for Part B, Part D, or both, potentially for the rest of your life.

12. Getting Help with Medicare Costs

Medicare costs can be a significant burden, but there are ways to get help. If you’re struggling to pay your Medicare premiums, deductibles, or copays, you may be eligible for financial assistance programs. The Extra Help program, for example, provides financial assistance with Medicare prescription drug costs. Additionally, Medicaid and the Medicare Savings Program can help with Medicare costs, such as premiums, deductibles, and copays. You can also contact your State Health Insurance Assistance Program (SHIP) office for guidance on getting help with Medicare costs.

8. How the Meagher Agency Can Help

Navigating Medicare and choosing the right plan can feel like a daunting task, but the good news is you don’t have to do it alone. The Meagher Agency specializes in helping individuals over 65 make informed decisions about Medicare, offering expert guidance on:

- Which Medicare plans are right for your health and budget

- Understanding how your existing health insurance may work with Medicare

- Comparing Medicare Advantage and Medigap plans to find the best option

- Avoiding common pitfalls like late enrollment penalties and gaps in coverage

Receiving your Medicare card is a crucial step in accessing Medicare benefits and services. The Meagher Agency can assist you in the application process, ensuring you receive your welcome package and Medicare card promptly.

At the Meagher Agency, we take the time to explain your options clearly and work with you to find a plan that fits your specific needs. Whether you’re looking for basic coverage or additional benefits like dental and vision, our team can help you navigate the complexities of Medicare with confidence.

9. Final Thoughts: Plan Ahead!

Turning 65 marks a new chapter in your life, and preparing for Medicare is a crucial part of that transition. Be sure to enroll in time, understand the different parts of Medicare, and consider your options carefully. With a little planning and the right assistance, you can ensure that your healthcare is in good hands for the years to come.

If you need help navigating the Medicare process, contact the Meagher Agency today. We’re here to make Medicare enrollment as smooth as possible and help you find the coverage that best fits your needs.

About the Meagher Agency

At the Meagher Agency, we specialize in Medicare insurance and help folks make informed choices about their healthcare coverage. Our experts are here to answer your questions and guide you through the entire process—from understanding the basics to selecting the right plan for you.